Top-Rated Austin Mortgage Lender

Flexible and Affordable Home Loans & Refinance Options in Austin, TX

Whether you’re buying your first home, upgrading, or refinancing, we offer low-interest mortgage solutions tailored to your needs. Trusted by Austin homeowners for expert advice, fast approvals, and competitive rates.

5/5 Stars on Google

Solution

Trusted Austin Mortgage Lender for Home Loans & Refinance Solutions

Looking for the best home loan rates in Austin, TX? Our expert mortgage team helps you secure affordable home financing—whether you’re buying your first home, upgrading, or refinancing. Get competitive interest rates, fast approvals, and personalized service from your local Austin mortgage experts.

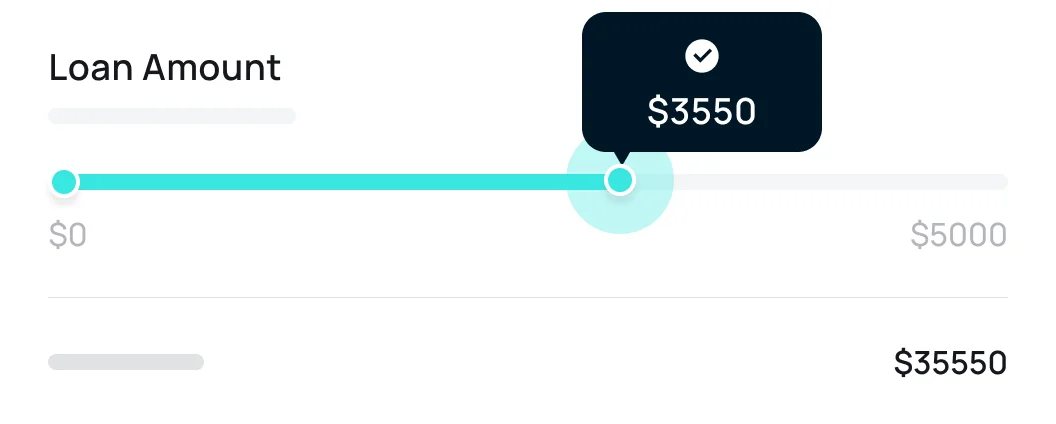

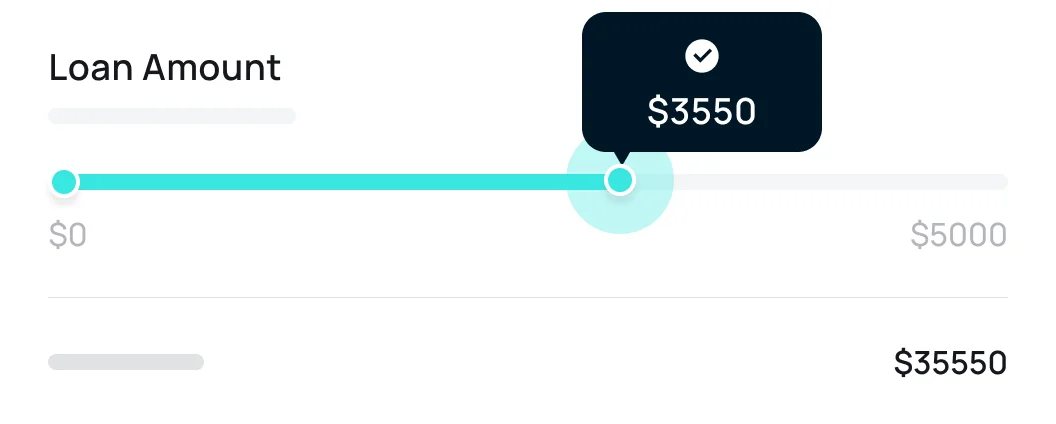

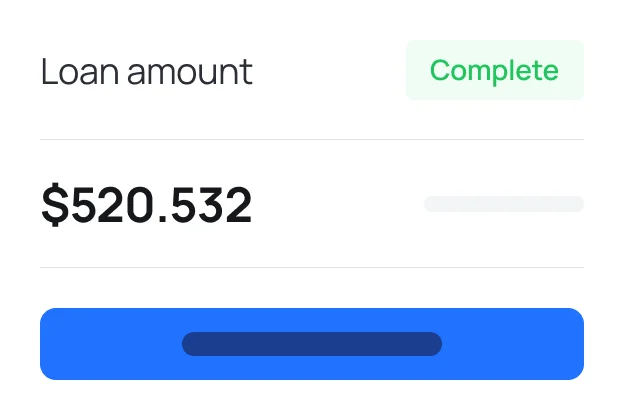

Fast & Easy Home Loan Pre-Approval

Get pre-approved online in minutes for your new home purchase. Whether you’re a first-time homebuyer or upgrading, our Austin mortgage experts guide you every step of the way with clear options and fast response times.

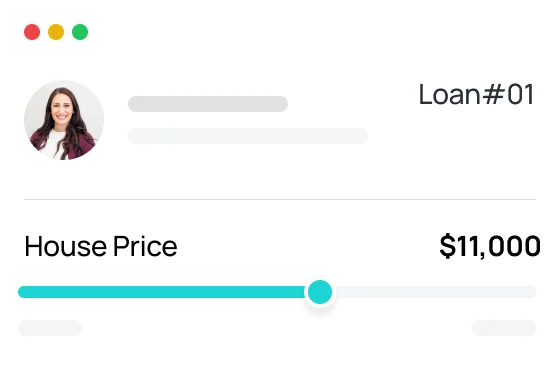

Tailored Loan Programs That Fit Your Life

We offer FHA, conventional, and VA loans with flexible terms that match your income, credit, and goals. Let us help you get into your dream home with a financing plan built around your needs.

Fast & Easy Mortgage Application Process

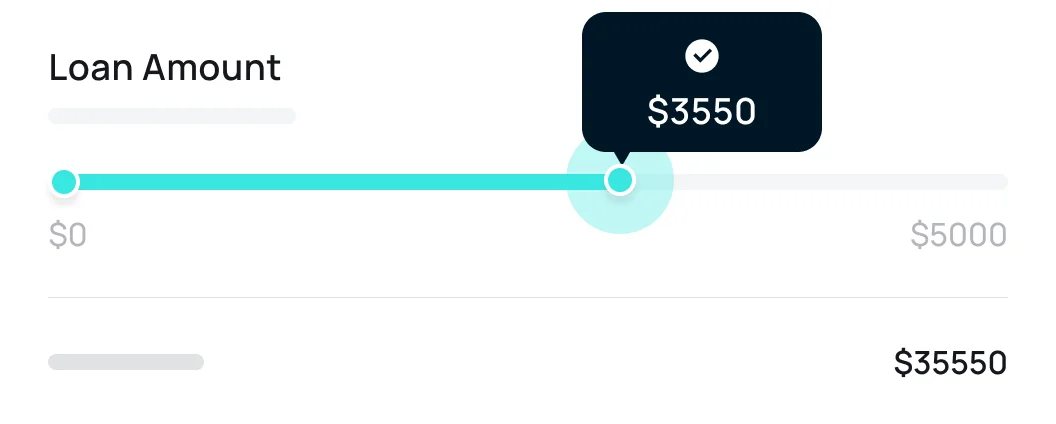

Apply online in minutes with our simple mortgage pre-approval process. Whether you’re looking for a conventional loan, FHA loan, or first-time homebuyer mortgage in Austin, we make it fast, easy, and hassle-free.

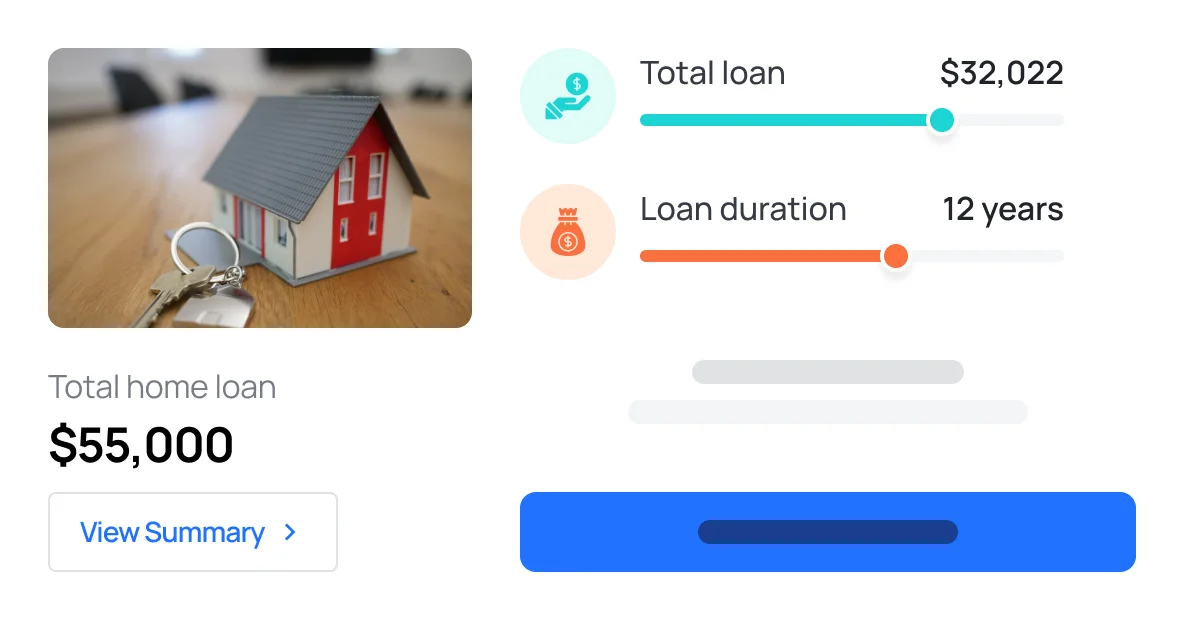

Customizable Repayment Plans Built for You

Choose from flexible mortgage repayment options tailored to your budget and lifestyle. Our Austin loan specialists work with you to find the best mortgage terms—so you can focus on your new home, not your monthly payment.

Simple & Streamlined Refinance Process

Refinancing your mortgage doesn’t have to be complicated. We make it fast and easy to lower your rate, reduce your payment, or cash out equity—so you can take control of your finances confidently.

Custom Refinance Options That Save You More

Our Austin refinance specialists compare top loan programs to help you save on interest, pay off your home faster, or access equity for renovations, debt consolidation, or major expenses.

Why Choose Us

Secure Your Financial Future with Low-Interest Mortgage Loans in Austin

Looking for affordable home financing in Austin, TX? We specialize in low-interest mortgage loans designed to help you buy, build, or refinance with confidence. Whether you’re a first-time buyer or seasoned homeowner, we offer expert guidance and competitive loan options tailored to your goals.

Easy Online Mortgage Application

Flexible Repayment Options for Any Budget

Competitive Rates from Top Austin Lenders

Loan Benefits

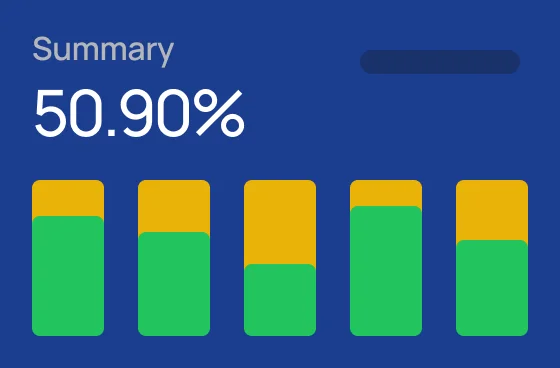

Take Control of Your Financial Future with Tailored Mortgage Solutions in Austin

Our Austin mortgage loans are built to give you more than just financing—they’re designed to give you peace of mind. Enjoy low-interest rates, predictable monthly payments, and flexible loan terms tailored to your financial goals. Whether you’re a first-time homebuyer or refinancing your current mortgage, our expert loan officers are here to guide you through a simple, stress-free process from application to closing.

Get the Austin Mortgage Experience You Deserve

At Mortgage Lending ATX, we combine local expertise, personalized support, and competitive rates to help you make confident, stress-free home financing decisions. Whether you’re purchasing or refinancing, we deliver the experience and service you deserve.

Austin-Based, Community-Focused

As a locally operated mortgage company, we understand the Austin market inside and out—giving you insights and options you won’t find with national lenders.

Clear, Ongoing Communication

Our team keeps you informed from start to finish. You’ll always know where you stand, what’s needed next, and how close you are to closing.

Transparent Loan Terms

We believe in honest lending. That means no hidden fees, no last-minute surprises—just straightforward mortgage options you can trust.

Fast Turnarounds Without the Headaches

We work efficiently to meet your timeline while maintaining quality and compliance. Whether you’re on a tight deadline or planning ahead, we’ve got you covered.

Modern Tech Meets Personal Touch

With user-friendly online tools and a dedicated team by your side, we make it easy to apply, qualify, and close on your Austin home—all with a human-first approach.

Customized Loan Solutions for Every Buyer

We don’t believe in one-size-fits-all lending. Our team takes the time to understand your unique financial goals and matches you with the best mortgage programs—whether you’re a first-time buyer, upgrading, or refinancing your current home.

Sally Tailor

"We were first-time homebuyers and had no idea what to expect, but Mortgage Lending ATX made it incredibly easy. They explained every step, responded quickly, and got us a great rate. We closed on our Austin home ahead of schedule!"

Martin Jones

"Working with a team that actually understands the Austin market was a game-changer. They helped us navigate a competitive offer and secure financing fast. Highly recommend to anyone buying in Central Texas."

David Fowler

"From pre-approval to closing, the Mortgage Lending ATX team was efficient, friendly, and completely transparent. No surprises, no delays—just great service."

FAQS

Frequently asked questions

We offer a wide range of home loan options including conventional loans, FHA loans, VA loans, and jumbo loans. Whether you’re a first-time buyer or looking to refinance, we’ll help you find the right fit.

Down payment requirements vary by loan type. Conventional loans typically require 3–20%, while FHA loans may allow as little as 3.5%. We’ll guide you through your best options based on your budget.

Most pre-approvals can be completed within 24–48 hours. Full loan approval and closing can take anywhere from 2 to 4 weeks depending on the complexity of the loan and documentation.

Yes! In fact, getting pre-approved first strengthens your offer when house hunting in Austin’s competitive market. It shows sellers you’re serious and financially ready to buy.

Most loan programs require a minimum credit score of 620, though FHA loans may allow lower scores. We’ll help you understand your credit standing and improve it if needed.

Austin continues to be one of the strongest housing markets in the country. With interest rates changing, it’s a great time to explore your options—whether you’re buying, refinancing, or building equity.